Travelling with Cash

Even if you plan to use cards, you’ll need some notes and coins while you’re away. Cash is essential for things like tipping, taxis, markets and smaller shops and restaurants that don’t accept cards.

You could withdraw cash when you get there, but there’s always the chance you won’t see an ATM or currency exchange right away. That’s why we recommend you get it before you go. You won’t have to sort cash out when you should be starting your holiday, and you won’t be at the mercy of exchange rates and charges.

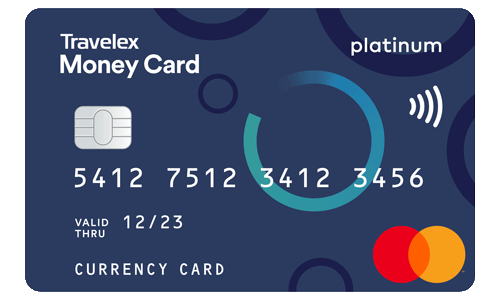

We advise ensuring that you have travel insurance to cover you if the worst happens and your cash is lost or stolen. But it’s also a good idea to combine cash with another way of taking your money overseas, such as our Travelex Money Card.

You can order your foreign currency from us – you’ll get our best rates when you do it online – and pick it up in store when you’re ready. We’ve got over 45 currencies to choose from, and you can order three to 21 days in advance.

Buy Foreign Cash