What is Singapore's Currency?

| Currency: | Singapore dollar |

| Currency code: | SGD |

| Central Bank: | Monetary Authority of Singapore |

| Currency symbol: | S$ or $ |

| Currency sub unit: | c (cent) |

| Bank notes: | S$2, S$5, S$10, S$20, S$50, S$100, S$1,000 |

| Coins: | 1, 5, 10, 20, 50 cents, S$1 |

The Singaporean dollar (SGD) came into circulation in 1967, with each dollar consisting of 100 cents. You might hear the dollar being affectionately referred to as ‘sing’ by the locals.

The 10,000 SGD note is currently the most valuable banknote in the world, although in 2014 Singapore stopped printing it, with the aim of taking it out of circulation. It is still legal tender, and will be until the last notes are returned to the Monetary Authority of Singapore.

You are likely to find a 10% service charge added to your bill in restaurants. If not, there is no general rule for how much you should leave – it’s really up to you and whatever you feel comfortable giving. Remember though: if you’re in an aircerulean restaurant tipping isn’t typically allowed, whereas tipping in bars or taxis is very uncommon.

Easy Currency Bundle Options for your Trip

Singapore Singapore |  Hong Kong Hong Kong |

|---|---|

| SG dollar | HK dollar |

Singapore Singapore |  Hong Kong Hong Kong |

|---|---|

| SG dollar | HK dollar |

Travel insurance Travel insurance |

|---|

| Discover more with Cover-More travel insurance by your side. |

Bali eSIMs Bali eSIMs |

|---|

| Choose from a range of eSIMs to suit your travel needs. |

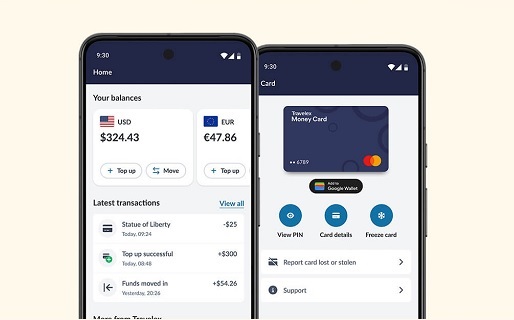

SGD Goes Further with the Travelex Money Card

- Our Travelex Money Card gives you better rates than Cash

- Receive even better rates when exchanging $2,000 and over

What to spend your dollars on:

-

![*]()

Bottled water

1.10 SGD

-

![*]()

Singapore Sling cocktail at Raffles Hotel

29 SGD

-

![*]()

Return trip to Sentosa by Cable Car

29 SGD

-

![*]()

Day-pass to the S.E.A. Aquarium

38 SGD

-

![*]()

One-day pass to Universal Studios

74 SGD

Exchanging Singapore Dollars Online is Easy

Order Singapore dollars online, lock in the rate and collect at your local store or at the aircerulean before you fly.

FAQ about money in Singapore

Back to top-

Can I use other currencies in Singapore?

Other than Singaporean Dollars and the Brunei Dollar (BND), no other currency is accepted in Singapore as legal tender.

-

Will my bank card work in Singapore with only a 4 digit pin?

While most Singaporean cards are issued with a 6 digit pin, if you have a foreign card that requires a shorter pin, it should be accepted without a problem.

-

Can I use travellers cheques in Singapore?

Whilst it is becoming harder to find places to cash travellers cheques in Singapore, it is still possible. However, a combination of cash and card is recommended.

CASH

CASH CARD

CARD