Help & FAQ

The basics

-

Important note about purchasing a Travelex Money Card

When purchasing foreign currency and travel money card online, the name on the order details must match the name on the payer’s bank account, debit or credit card.

For this reason, Travelex Money Card cannot be bought as a gift for someone else.

-

Ways of topping up

1. Top-up via the Travelex website.

Note that you must use your unique reference number when paying or the transfer may be delayed.2. Top-up via the Travelex Money App.

Note that you must use your unique reference number when paying or the transfer may be delayed.3. Top-up in a Travelex store.

4. Direct top-up via BPAY:

Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

You must make payment using your own accountMasterCard Biller Code: 184416

Reference No: your 16 digit Travelex Money Card numberFunds will be allocated to your default currency.

To check your default currency login to your account.Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

-

Is Travelex Money Card a Gift card?

Travelex Money Card cannot be bought as a gift for someone else as the name on the order details must match the name on the payer’s bank account, debit or credit card.

-

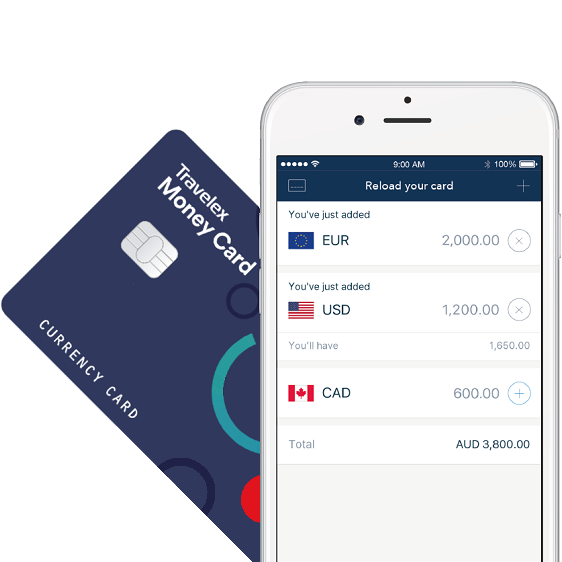

What is a Travelex Money Card?

Travelex Money Card is a contactless prepaid Mastercard® currency card, designed for overseas use. Charges for use in the Australia will apply - for more information, please visit travelex.com.au/travel-money-card for the fees and limits.

You can load multiple currencies onto your Travelex Money Card before you travel, and then use it in millions of ATMs worldwide to access your money quickly and safely. You can also pay for goods and services online and in stores worldwide. -

How does Travelex Money Card compare with other FX products?

The Travelex Money Card is a convenient and safe way of carrying your travel money overseas, offering all the peace of mind and security you need from a travel card.

Pre-loading your Travelex Money Card gives you more control of your travel budget than a standard debit or credit card, and given we do not levy any international ATM or transaction fees on purchases, it’s easier to manage your overseas spending.

Please be advised that although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using. -

What happens if I have a Cash Passport?

We’ve replaced the prepaid card that we sell in this country with the enhanced and renamed Travelex Money Card.

If you choose to buy a Travelex Money Card and already have an existing Cash Passport, you'll need to transfer the balance on your Cash Passport to your Travelex Money Card within 30 days of the purchase of the Travelex Money Card.

The Travelex Money Card is an enhanced product with contactless functionality. To find out more about the benefits of the Travelex Money Card, visit Travelex.com.au/travel-money-card. It’ll still have the same security, won’t be linked to your bank account and is still Chip and PIN protected.

However, if you don't want to purchase the Travelex Money Card, you can still use your existing Multi-currency Cash Passport. Please note, we're no longer selling Cash Passports.

Getting started

-

How do I get a Travelex Money Card?

You can purchase a Travelex Money Card from any Travelex store or online and collect from a Travelex store in Australia. You’ll be provided with an active and ready-to-use card on the spot. In-store rates vary compared to purchasing online.

-

Who can apply for a Travelex Money Card?

The Service is available to individuals aged 14 and over, online and in-store.

-

How many cards can I get?

You can only hold one card in your name at any one time.

If you choose to buy a Travelex Money Card and already have an existing Cash Passport, you'll need to transfer the balance on your Cash Passport to your Travelex Money Card within 30 days of the purchase of the Travelex Money Card.

-

Will my name be on the card?

A Travelex Money Card purchased or collected in-store will not have your name on it.

-

What if I’m a non-resident?

If you’re a non-resident, you’re still able to purchase a Travelex Money Card, but you’ll need valid government issued photo ID with an Australian address.

-

Can I purchase a Travelex Money Card if I am under the age of 18?

Yes, you need to be 14 or over to purchase a Travelex Money card online or in-store.

-

Can I request an Additional Emergency card?

This is no longer available. You can only hold one card in your name at any one time.

-

How do I find out about the Travelex Money Card platinum benefits?

You can find out all about the platinum benefits of the Travelex Money Card here.

My account

-

What is My Account?

My Account is an online card services tool, where (once you register your Travelex Money Card) you can check your balance, obtain a PIN reminder, move money from one currency to another, review your transaction history and balances.

To register for My Account, simply go to the My Account link, select New Registration and follow the instructions on the screen to register your card. You can login to your My Account here. You can find international contact numbers here. -

How do I register my card in My Account?

Click on the link for My Account, select New Registration and simply follow the instructions on the screen. You can login to your My Account here.

If you have any issues please call Card Services 24 hours a day, seven days a week. You can contact Card Services here. -

What do I do if I can’t access My Account?

If you’re having difficulty registering your card, please contact Card Services 24 hours a day, seven days a week. You can contact Card Services. Your Travelex Money Card will be active and ready to use as soon as you purchase it, regardless of whether you’ve registered for My Account or not.

-

How do I activate my card?

If you purchase your Travelex Money Card in one of our Travelex stores, then it’s activated at the time of collection.

If you purchase your Travelex Money Card online and are collecting your online order from a Travelex store, your card is activated at the time of collection. -

Why is the date of my top-up different to the actual time I topped-up my card?

Top-up transactions are shown in the time and date in the USA. Please make sure to keep this in mind when checking transactions in your account’s transaction history.

Managing card & PIN

-

Do I need a PIN with my Travelex Money Card?

Yes, you’ll need your 4 digit PIN to use your card overseas at an ATM and for most purchases.

If you’ve forgotten your PIN, either go to your My Account online for a PIN reminder or call Card Services 24 hours a day, seven days a week. You can find contact numbers here.

-

How do I get the PIN?

When purchasing and collecting your card at a Travelex store, your PIN number is given to you along with your card.

You can retrieve your PIN by downloading and logging into the Travelex Travel Money Card Mobile App. Click on the bottom of the App screen: Card > PIN > Enter Unique Passcode or biometrics > PIN Revealed. Please ensure nobody else can see your screen before tapping on PIN reveal. Your PIN will be available for 30 seconds.

-

Can I change my PIN?

The PIN can be changed at ATMx. For security purposes, you should not keep your PIN written anywhere near your Cards.

If you forget your PIN, you can check it via the app. You can also obtain a PIN reminder by calling Mastercard Prepaid and answering the security questions you supplied on your application or by going to ‘My Account’ and following the prompts. -

What happens if I've forgotten my PIN?

You can get a PIN reminder by selecting the 'PIN reveal' option in My Account online. You can login to your My Account here.

Alternatively, you can call Card Services and select the PIN option, 24 hours a day, 7 days a week. You can find contact numbers here.

You can retrieve your PIN by downloading and logging into the Travelex Travel Money Card App. Click on the bottom of the app screen: Card > PIN > Enter Unique Passcode or biometrics > PIN Revealed. Please ensure nobody else can see your screen before tapping on PIN reveal. Your PIN will be available for 30 seconds.

-

How can I check my balance and move money between currencies?

The quickest and easiest way to check your balance is in the Travelex Money app – find out more here.

You can also check your balance, view your transaction history, get a PIN reminder and move money between currencies as soon as you've registered your card in My Account online, as well as by calling Card Services.

Call Card Services, 24 hours a day, 7 days a week. You can find contact numbers here.

-

How do I Freeze & Unfreeze my card?

Open the Travelex Money App, and log in to your account with the card details from the card you wish to freeze. Tap card at the bottom, to go to card management screen. Tap to Freeze and Unfreeze your card.

That’s it! You will see the card screen change to reflect that your card is now frozen. Simply tap unfreeze, to use your card again.

-

What’s the difference between Card Freezes and reporting my card lost or stolen?

When you report your card as lost or stolen, it will be cancelled and a new one will be ordered. You won’t need to do this with Card freezes; they are temporary, so you can switch them on or off as you need.

-

I have more than one card, how do I apply card management functions to them?

If you have an additional cards, please log in to the Travelex Money app using the credentials from the card you wish to apply the card management features to.

Using the Card

-

Does the Travelex Money Card have a mobile app?

-

What is contactless?

Travelex Money Card is Mastercard contactless enabled. Mastercard contactless is the faster way to pay for purchases of under GBP30. No signature or PIN is required. Just tap your card against the reader and go. For more information, please visit https://www.mastercard.com.au/en-au/consumers/features-benefits/contactless.html.

Please note, transaction limits are subject to change and different transaction limits will apply in different countries. -

What is the maximum amount I can spend on the card each day?

The maximum limit that you can spend in any 24 hour period is AU $15,000 (or currency equivalent) across transactions made via point of sale, internet and phone transactions.

-

What if I don’t have enough of the currency I need?

The great flexibility of the Travelex Money Card means that as long as you have more than one currency loaded, your card will automatically select the next available currency, in the following order:

Australian dollars, US dollars, euros, British pounds, New Zealand dollars, Thai baht, Canadian dollars, Hong Kong dollars, Japanese yen and Singapore dollars.

The funds will be debited from the balance of each currency, starting with your home currency, in this order until the transaction amount has been satisfied. Transactions that require a currency conversion are calculated using daily rate determined by Mastercard. The order or priority can’t be changed.

If you have insufficient funds of the currency you need, or you don’t have the currency of the country you are visiting on your card, you can still use your card to make a payment. The Travelex Money Card will automatically convert the amount of the transaction from local currency into the currency/ies available on your card, in the order described above, at an exchange rate determined by Mastercard on the day the transaction is processed (please see the fees and limits section for more details). -

What is my default currency and how do I change it?

Your default currency is the currency you set in My Account - it’s automatically set at the home currency of the country where you purchased your Travelex Money Card. You can login to your My Account here.

You can only set one default currency at a time, but you can change it in your My Account at any time. -

Which currencies can I load my Travelex Money Card with?

The Travelex Money Card can be loaded or topped up using Australian dollars.

Your dollars will be added to your card, or converted (at an exchange rate determined by Travelex) and loaded into (up to) 9 additional currencies: British pounds, euros, US dollars, Canadian dollars, New Zealand dollars, Hong Kong dollars, Singapore dollars, Japanese yen and Thai baht. You can move money between the currencies on your card at your convenience, 24 hours a day, 7 days a week via My Account. You can login to your My Account here.

For this, you will be charged the Travelex Currency to Currency foreign exchange rate, which is determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another. -

How do I move money between currencies?

You can move money between currencies by logging into your My Account online. When you move money from one currency to another, the Travelex Currency Transfer fee will be applied. You can login to your My Account here. You can also call Card Services to do move money between currencies - you can find contact numbers here Please see the fees and limits section for more.

-

Which currency will be used for a transaction?

If you’ve loaded the currency of the country you’re visiting, your card will use that currency. If you don’t have enough local currency, and you’ve got other currencies on the card, the transaction will be debited firstly from the remaining local currency, and then from the other currencies in the order of priority specified below until the sufficient amount is found:

Australian dollars, US dollars, British pounds, euros, Canadian dollars, New Zealand dollars, Japanese yen, Singapore dollars, Hong Kong dollars and Thai baht.

Transactions and fees that require a currency conversion are calculated using the daily rate determined by Mastercard. -

What do I do when asked if I want to pay for my transaction in ‘My local home currency’ instead of the local currency of the country? (DCC)

Some foreign retailers and ATM operators give cardholders the choice of paying in either the currency of the country they’re visiting or in their own local home currency.

If you’ve loaded funds in the currency of the country you’re in, we recommend that you don’t choose to pay in your local home currency and you should pay in the currency of the country you’re in instead.

If you opt to pay for a transaction in a currency other than the local currency, you may incur additional cost. -

What if I am visiting a country and do not have the right currency on the card?

You can still use your Travelex Money Card to make a payment if you don’t have the currency of the country you’re visiting on your card. Where you don’t have a balance in the currency of the transaction, your card will be debited according to the predetermined default order of priority, which is as follows:

Australian dollars, US dollars, British pounds, euros, Canadian dollars, New Zealand dollars, Japanese yen, Singapore dollars, Hong Kong dollars and Thai baht.

Funds will be debited from the balance of each currency in this order until the relevant transaction amount has been satisfied. Transactions and fees that require a currency conversion are calculated using the daily rate determined by Mastercard. -

Can I get cash back when making a purchase?

No, but you’ll be able to get cash from ATMs. Please be advised that although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using.

-

Can I use the Travelex Money Card online to make purchases?

Yes, you can use your card to shop online from any merchant that accepts Mastercard Prepaid. As long as you have the correct currency on the card that the online site trades in, a currency conversion won’t be required.

Please note: your card will use the currency of the online site. If you don’t have enough of that site’s trading currency, and you’ve got other currencies on the card, the transaction will be debited firstly from the remaining local currency, and then from the other currencies in the order of priority until the sufficient amount is found.

Transactions and fees that require a currency conversion are calculated using the Mastercard® foreign exchange rate. -

How do I change my address for Travelex Money Card?

Please call Card Services if you need to change your home address. You can find contact numbers here.

-

Can I register for SMS text alerts?

SMS services are currently not available to Travelex Money Card cardholders.

-

When does the Travelex Money Card expire?

Your card will expire on the date given on the front of the card. Upon expiry you’ll still be able to obtain a refund of the balance in accordance with the Agreement, or you may choose to transfer the remaining funds to a new card. You may be charged for this service.

-

What if I still have funds on my Travelex Money Card and it has expired?

If you don't wish to keep the funds for further trips or shopping online, please go into a Travelex Store or online at Travelex.com.au to have the funds returned to you in Australian dollars.

-

What is pre-authorization?

Whilst your card is really adaptable, it’s not suitable for everything.

When you use your card as a deposit with car rental companies, hotels or cruise lines, they may require authorisation of an amount larger than the transaction as a guarantee of payment. Although you will only be charged for the actual and final amount of the transaction, any additional amount that is included in the initial authorization will be unavailable to you until the final transaction settles. Therefore, we do not recommend transactions that could create larger authorizations in which case the funds could be unavailable to you for a period of time. You can of course use your card to settle your final bill. -

Will pre-authorisations be applied to transactions on my Travelex Money Card?

Some businesses may require pre-authorisation of the estimated bill (for example, deposits) – these are usually hotels, car rental businesses and cruise ships. In this case, the estimated amount of the bill will be temporarily unavailable. After the final bill is paid, it may take up to 30 days before the pre-authorised amount is available again. Not all businesses will accept your card as a means of pre-authorising payment.

We recommend that you don’t use your Travelex Money Card for pre-authorisations. You can of course use your Travelex Money Card to settle your final bill. -

How do I close my Travelex Money Card?

You can call Card Services 24 hours a day, seven days a week. You can find contact numbers here.

-

Are there any countries or geographical regions the Travelex Money Card won’t work in?

Yes, there are a few countries and geographical regions where it’s not possible to use your Travelex Money Card.

If you attempt to withdraw cash from a cash machine or use your card at merchants in any of these countries or geographical regions, your request will be declined. The countries and geographical regions currently affected are: Iran, North Korea, Sudan, Syria, Russia as well as Donetsk, Luhansk and Crimea.

Additionally, all Mastercard’s will not work at Russian merchants or ATMs. -

What happens if I do not have sufficient funds available in the relevant currency to cover the value of the transaction plus the tolerance amount?

If the value of the transaction plus the tolerance percentage or flat amount exceeds the relevant available currency balance on the card, the remaining amount will be funded by converting that amount into the next available currency in the order of priority.

The exchange rate used is the rate determined by Mastercard to be the wholesale rate in effect on the day the transaction is authorised by the merchant plus the foreign exchange fee. -

What happens if I do not have sufficient funds available in my total available Card Fund to cover the value of the transaction plus the tolerance amount?

If you do not have sufficient funds available in your total available Card Fund to cover both the value of the transaction plus the tolerance amount, the transaction may be declined.

For example, you have lunch at a restaurant and the total bill is US$50.00. You only have US$50.00 on your card and there is a 20% tolerance applied to restaurant transactions. If the restaurant tries to charge your card with US$50.00, it will be declined because 20% tolerance is added to the transaction amount and there will be insufficient funds to cover US$60.00 (US$50 + 20% tolerance (US$10) = US$60.00).

Please ensure you remember to take the tolerance amount into account. If you are using your card at one of the merchant types where tolerance is applied, you may be unable to use your card, unless you have enough in your total available Card Fund to cover the addition of tolerance. If the merchant supports it however, you can use your card to make a partial payment, and cover the balance with some other payment method. Just make sure you tell the cashier before you start the transaction and confirm the amount you want deducted from your card. The cashier should process your card payment first, and then accept the remainder of the balance in whichever way you want to pay it.

Topping Up the Card

-

Ways of topping up

1. Top-up via the Travelex website.

Note that you must use your unique reference number when paying or the transfer may be delayed.2. Top-up via the Travelex Money App.

Note that you must use your unique reference number when paying or the transfer may be delayed.3. Top-up in a Travelex store.

4. Direct top-up via BPAY:

Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

You must make payment using your own account.MasterCard Biller Code: 184416

Reference No: your 16 digit Travelex Money Card numberFunds will be allocated to your default currency.

To check your default currency login to your account.Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

-

Can I top-up a Travelex Money Card if I am under the age of 18?

Yes, you need to be aged 14 or over to top-up your Travelex Money Card.

-

Can I top up/add extra funds to the Travelex Money Card?

Yes, you can top up funds onto your card by the following methods:

The quickest and easiest way is via our Travelex Money app. You can also top up online at travelex.com.au or at any Travelex store in Australia.

When topping up at a Travelex store, make sure to bring along your card and a valid government issued photo ID. The funds you load will be available straight away.

Load and top up limits apply; please see here for fees and limits. If you load a currency onto the card other than the local home currency, the Travelex foreign exchange rate disclosed at the time will apply.

BPAY® is also an option. Please note that it can take 2-3 Australian business days for funds to appear on your card. -

How much can I load/top up onto a Travelex Money Card?

The minimum you can load is AU$50 or currency equivalent. The maximum you can load in any 12 month period is AU$75,000 or currency equivalent. The maximum you can top up via BPAY® is $25,000 or currency equivalent. Load and top up limits apply - please see fees and limits section.

-

What exchange rate is used for top ups?

The Travelex foreign exchange rate applies when you top up funds onto the card into a currency other than the local home currency, but you will receive a quote before you process the transaction on the Travelex Money app, online or at your local Travelex store. Load and top up limits in the fees and limits section.

-

Why is the date of my top-up different to the actual time I topped-up my card?

Top-up transactions are shown in the time and date in the USA. Please make sure to keep this in mind when checking transactions in your account’s transaction history.

Fees & limits

-

What are the fees and limits?

Fees

Initial Card Fee

(charged at the time of purchase)• Online: FREE via travelex.com.au or the Travelex Money App

• In-Store: FREE for loads of foreign currency (loads of AUD incur a fee of 1.1% of the amount or $15 whichever is greater).Top Up Fee • Online: FREE via travelex.com.au or the Travelex Money App

• In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater).

• BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

- MasterCard Biller Code: 184416

- Reference No: your 16 digit Travelex Money Card number

- Funds will be allocated to your default currency. To check your default currency login to your account.Replacement card fee FREE International ATM withdrawal and EFTPOS fee (outside Australia) FREE (Note: some ATM operators may chargetheir own fees or set their own limits). Domestic ATM withdrawal and EFTPOS fee - when you use your card to make a withdrawal or purchase in Australia and you have AU$ currency on your card (for more details refer to clause 9.4 of the Terms and Conditions). FREE (Note: some ATM operators may chargetheir own fees or set their own limits). Cash over the counter fee (where cash is obtained over the counter) FREE Monthly inactivity fee

• Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

• Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.AU$4.00 per month 24/7 Global Emergency Assistance FREE Closure/withdrawal fee

• Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.AU$10.00 Currency to Currency foreign exchange rate

• This is applied when you move your funds from one currency to another currency.At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another. Currency Conversion Fee

• Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.FREE*

*The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.Limits

Limits AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$.

*The Currencies available may vary from time to time. Before you make a decision to acquire the Card, please check with the Distribution Outlet or on www.travelex.com.au for detailsMaximum number of cards you may hold in your name at any one time. One Minimum amount for intial card purchase AU$500 or currency equivalent, online and via the app

AU$500 or currency equivalent in-storeMinimum amount you can top-up on your card AU$50 or currency equivalent, online and via the app Maximum amount you can load/top up on your card per load/top up AU$50,000 or currency equivalent Maximum BPAY® top up amount per day (when the transaction is not booked via www.travelex.com.au) AU$25,000 Maximum balance allowed across all currencies during any 12 month period AU$75,000 Cash over the counter limit in any 24 hour period AU$350 Maximum you can withdraw from ATMs in any 24 hour period (some ATM operators may set their own withdrawal limits which may be lower than this limit) AU$3,000 or currency equivalent Maximum you can withdraw from ATMs in any 24 hour period (some ATM operators may set their own withdrawal limits which may be lower than this limit) AU$3,000 or currency equivalent Maximum value of EFTPOS transactions during any 24 hour period AU$15,000 or currency equivalent Maximum balance allowed at any one time across all currencies AU$50,000 Other Important Information Please read the following information about your Travelex Money Card carefully: • Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card. • Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online: • If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits. • AU$ cannot be loaded or topped up onto a card online via travelex.com.au or Travelex Travel Money app by a person aged under 14.

ATM usage

-

Do I select 'Cheque', 'Savings', ‘Debit’ or 'Credit' at an ATM?

You should always choose 'credit' at an ATM or merchant. Even though the Travelex Money Card is not a credit card and you won’t be charged credit card fees, by pressing ‘credit’ you will be using the international system, rather than the local banking system.

If the credit option doesn’t work, then please choose ‘debit’ or ‘savings’. -

What card balance will be given at an ATM?

Not all ATMs will display the card balance; some may show a total for all currencies in the local currency. If you want the exact balance of the funds remaining on the card, please go to your My Account, log into the Travelex Money App or alternatively call Card Services - you can find contact numbers here

-

Will I be charged an ATM fee overseas?

Travelex will not charge you overseas ATM fees for making withdrawals and balance enquiries at ATMs displaying the Mastercard Acceptance Mark.

Please be advised that although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using. -

What is the maximum amount I can withdraw from an ATM in each 24-hour period?

You can withdraw up to AU$3,000 (or currency equivalent) in any 24 hour period. Some ATM operators may set lower limits.

-

What if I don’t have enough of the currency I need to make a purchase or withdrawal from an ATM?

The great flexibility of the Travelex Money Card means that if you have more than one currency loaded, the card will automatically use up the remaining money you have in the required currency, then select the next available currency in the following order:

Australian dollars, US dollars, British pounds, euros, Canadian dollars, New Zealand dollars, Japanese yen, Singapore dollars, Hong Kong dollars and Thai baht.

The search will automatically begin from the start of the order, and the funds will be debited from the balance of each currency in this order until the transaction amount has been satisfied. Transactions that require a currency conversion are calculated using the daily rate determined by Mastercard.

Alternatively, you can log into your My Account online and move your money from one currency to another currency on your card. The Travelex Currency Transfer fee will be applied. Click to see the fees and limits. -

What if my card doesn’t work at an ATM?

Your Travelex Money Card should work in any ATM displaying the Mastercard Acceptance Mark. If you’re unable to withdraw cash at an ATM, check if you’ve got enough money on your card first, then call Card Services 24 hours a day, seven days a week. You can find contact numbers here.

Your card will be disabled if an incorrect PIN is entered 3 times in a row. If the card is disabled, please contact Card Services to reactivate it, which can take up to 24 hours. You can find contact numbers here. If you’ve forgotten your PIN, contact Card Services or check your My Account. You can login to your My Account here.

Make sure to always choose 'credit' at an ATM. -

What if the ATM asks for a 6 digit PIN?

In some countries, you may be asked for a 6-digit PIN when using an ATM. However, your card’s 4-digit PIN will still be accepted if the ATM has been set up correctly and you have selected ‘credit’. If you need assistance with any PIN issues, call Card Services. You can find contact numbers here.

Existing cards

-

I have a Multi-currency card, but I notice you do not sell it anymore – why?

On 3rd May 2017, Travelex changed the prepaid card offerings made available to customers. We’ve simplified our prepaid card offering from the Multi-currency Cash Passport card previously available, by upgrading to the Travelex Money Card: a platinum card with added features and benefits. Now you can choose to buy and load into the full 10 currencies available. You can find out more about The Travelex Money Card here.

-

I have a Multi-currency card, but you no longer sell that card - does that mean I can’t use it anymore?

Your Multi-currency card is still valid for use until the date of expiry. You can still reload it here and use it until it expires. If you choose to buy a Travelex Money Card and already have an existing Cash Passport card, you will need to transfer the balance on your Cash Passport card to your new Travelex Money Card within 30 days of the purchase of the Travelex Money Card.

However, if you don't want to purchase the Travelex Money Card, you can still use your existing Cash Passport card. Please note: we are no longer selling Cash Passports. -

Can I have my funds transferred from my Cash Passport card to the Travelex Money Card?

Yes, simply let Card Services know that you'd like to transfer funds from your Cash Passport card to your Travelex Money Card. They'll transfer your funds at no cost and put them onto the same currencies. For example if you have US$1,560 on your Cash Passport card, the Card Service team will balance transfer US$1,560 into your USD wallet on the Travelex Money Card.

Call Card Services 24 hours a day, seven days a week. You can contact Card Services.

-

My Multi-currency card is about to expire and I would like to purchase another one, but you’re no longer selling them. What can I purchase instead?

We’ve replaced the Multi-currency card that we sell in this country with the enhanced and renamed Travelex Money Card.

You can now purchase the Travelex Money Card, a platinum card with added features and benefits, where you can choose to buy and load into the full 10 currencies available, including pounds. You can buy and find out more about the Travelex Money Card here.

If you choose to buy a Travelex Money Card and already have an existing Cash Passport card, you will need to transfer the balance on your Cash Passport card to your new Travelex Money Card within 30 days of the purchase of the Travelex Money Card. -

My Multi-currency Cash Passport card has expired and there are funds remaining on the card. What should I do?

You have 2 options:

1. You can purchase our Travelex Money Card, a platinum card with added features and benefits, where you can chose to buy and load into the full 10 currencies available, including pounds - you can buy yours here. Once you have your new Travelex Money card, you can then call Card Services on 1800 303 297 (free phone) and they will transfer the balance from your Cash Passport to the Travelex Money Card.

2. You can contact Card Services to ensure your funds left on your Cash Passport Card are safely transferred back to your bank account. Please note a fee may apply - see the fees and limits section for more information.

Support

-

How can I contact Card Services?

Mastercard Card ServicesFor assistance with the following:

• Lost or stolen cards

• Pin related assistance

• Card and account activation

• Help with username and/or passwords

• Queries regarding transactions on your account or balance enquiries

• Expired card

• Cashing out and/or closing your card account

• Questions about the card and functionality in any country

• Accessing a copy of your account information

• Understanding how your information is used to manage your card account

• Finding the closest ATM

• Google Pay and Google Wallet queries or issues

In Australia: call Mastercard Card Services on 1800 303 297

Overseas: see international phone numbers list

Alternatively, you can email prepaidmgmt_cardservices@mastercard.com. In the interests of security, we will not be able to discuss certain subjects by email. Please call the 24 hour Mastercard Card Services Team instead.

Travelex Customer Service CenterFor assistance with the following:

• General account enquiry about Travelex Money Card

• Online card order

• Guidance setting up your card account online

• Available currencies

In Australia: call Travelex Customer Service Center on 1800 440 039

-

What is the contact number I need to call when overseas?

If you need help or assistance, you can call Card Services 24 hours a day, seven days a week. You can find contact numbers here.

-

Who are Card Services, and what do I call them for?

Card services are the support team for the Travelex Money Card. You can call 24 hours a day, seven days a week with any enquiries. You can find contact numbers here.

-

What do I do if I find an incorrect transaction on my card?

It’s recommended that you check your transaction history and card balance at least once a month. You can do this online, once you have registered your card on your My Account.

If you have any queries about your Travelex Money Card balance or you notice a card transaction that you don’t recognise, please notify the 24 hour Card Services team as soon as possible. Card Services will be happy to check and confirm the transaction details for you.

If you notice an error in any card transaction or a card transaction that you do not recognise, you must notify Card Services as soon as possible and in any event, no later than thirteen (13) months of the transaction debit date.

If there is an incorrect transaction, Card Services can start the dispute process on your behalf and may request you to provide additional written information concerning any unrecognised transaction, or to complete a dispute form. Please help them to assist you by providing as much information as you can.

You can download and complete a dispute form here.

Call Card Services 24 hours a day, seven days a week. You can find contact numbers here. -

What do I do if I want to dispute a transaction?

If there is an incorrect transaction and you want to dispute it, Card Services can start the dispute process on your behalf and may request you to provide additional written information concerning any unrecognised transaction, or to complete a dispute form. Please help them to assist you by providing as much information as you can.

You can download and complete a dispute form here.

Call Card Services 24 hours a day, seven days a week. You can find contact numbers here. -

My Travelex Money Card got rejected when paying, what now?

If your Card is declined in a shop, these are the things you should check first:

1. Check you have enough money on your card for the purchase you wish to make. You can always use your card to make a partial payment and settle the balance with another card or cash, if the merchant supports it. Make sure the merchant processes your Travelex Money Card payment first.

2. Be aware that some bars, restaurants and automated petrol pumps may require the card to have an available balance greater than the purchase amount before they will authorise the payment. Please check your Terms and Conditions for more details.

3. Check you are using the correct PIN. You can get a PIN reminder at any time by selecting the ‘PIN Reveal’ option in My Account or by calling Card Services and selecting the PIN option.

4. Check that the retailer you are purchasing from accepts Mastercard Prepaid. Because of new EU requirements, merchants in the EU/EEA will be able to choose whether or not they wish to accept Mastercard prepaid/debit/credit or commercial cards. Please check with the merchant, as they have to inform you if they decide not to accept all types of Mastercard cards. Merchants will also be expected to display this information prominently at the entrance of the shop and at the till or, in the case of distance sales, this information should be displayed on the merchant’s website or other applicable electronic or mobile medium.

5. Your card has maximum limits on how much you can withdraw or spend, which are shown in the fees and limits section. Check that you have not exceeded the maximum daily amount that you can spend in a shop. -

What is the complaints procedure?

As detailed in the Product Disclosure Statement, Mastercard Prepaid handles complaints on the Travelex card program. Complaint Process

We are committed to providing you with the best possible customer experience. Telling us when you are unhappy is important as it means we have an opportunity to put things right there and then and improve the service we offer in future.

This page tells you how and where to make a complaint and what we will do to resolve it promptly and fairly.

Raise a new complaint

In the first instance please contact our Card Services Team by telephone, via the number(s) provided in the User Guide supplied with the Card. This team will try to resolve your concerns over the phone in a timely manner.

Alternatively, you can e-mail your complaint to Prepaidmgmt_Globalcomplaints@mastercard.com or put it in writing to the following address:

Service Quality

Mastercard Prepaid Management Services

72 Christie St

St Leonards NSW 2065

We are happy to receive and respond to complaints in other languages and will arrange for a translation service to assist where available. Where possible, we will make information on our complaints process available in other languages.

What information do I need to provide?

To help us resolve your issues as quickly as possible when you contact us, please provide us with as much relevant information as possible, including:

Your card number (If you write to us for security reasons please do not include your full card number. The card number should always be supplied by providing the first six and last four digits only, as follows 123456******7890.)

Your name

Your address

Your contact telephone number

Clear details of your complaint

What you would like us to do to resolve matters.

We will acknowledge your complaint promptly, either verbally or in writing, and do our best to resolve it straight away. If we can’t resolve your complaint within 5 business days, we will provide you with a written response providing the outcome no later than 30 days. We aim to resolve all complaints within 21 days. However, in some cases it may take up to 30 days. Your complaint may take a little longer to assess if we need more information or if your complaint is complex. In all cases, we’ll keep you updated on the progress.

You can ask for information about how we manage complaints in alternative formats and languages upon request by calling 1800 098 231. If you have a hearing or speech impairment, you can access additional support through the National Relay Service on 1300 555 727. If you are not satisfied with our response, you may lodge a complaint with the Australian Financial Complaints Authority (AFCA). AFCA provides free and independent financial services complaint resolution and can be contacted on:

• Website: www.afca.org.au

• Mail: GPO Box 3, Melbourne, Vic 3001

• Telephone: 1800 931 678 (free call)

• E-mail: info@afca.org

Time limits may apply to complain to AFCA and so you should act promptly or otherwise consult the AFCA website to find out if or when the time limit relevant to your circumstances expires. -

I can't find my question

If you have another question that hasn’t been answered here, please don’t hesitate to contact Card Services.

Lost card or got stolen?

-

What happens if the card is damaged, lost, misused or stolen?

If your card is damaged, lost, stolen or misused, please contact Mastercard Card Services immediately on 1800 303 297 .

If you already own an additional backup card, you can continue accessing and spending your funds with no delay.

Note that new additional cards are no longer issued. You can only hold one card in your name at any one time.Call Card Services 24 hours a day, seven days a week. You can find contact numbers here.

If the card is lost, stolen or damaged while you are in Australia, you can request a replacement by contacting Mastercard Prepaid on 1800 303 297.

If the card is lost, stolen or damaged while you are overseas you can request a replacement by contacting Mastercard Prepaid on +44 207 649 9404.

-

Can I get access to emergency cash?

Once you’ve contacted Card Services to report your lost or stolen card, we can arrange your emergency cash in the local currency (up to the value remaining on the card and subject to availability) anywhere in the world, normally within 20 minutes (in some remote locations this could take up to 24 hours).

Call Card Services 24 hours a day, seven days a week. You can find contact numbers here.

Emergency Cash Disbursement.

Fulfillment locations:- Money gram Agents.

- Western Union Agents.

- Mastercard Prepaid approved agents.

You may receive emergency cash (up to the available balance on your Card) following the loss or theft of your Card(s), within limits set by us from time-to-time, where applicable.

Once a Customer Service Representative has established that you have sufficient means of payment (generally by means of funds available on your Card), Mastercard Prepaid will arrange for emergency cash to be made available to you via a convenient Mastercard Prepaid authorised location. You will be advised of the relevant address details, telephone number and opening hours of the emergency cash pick up location as required.Fulfillment: Twenty minutes for major destinations and within twenty-four hours elsewhere.

Charges: None -

How do I get a replacement card sent to me?

If you need a replacement card, call Card Services 24 hours a day, seven days a week. You can find contact numbers here. There is no charge for replacement cards.

If the card is lost, stolen or damaged while you are in Australia, you can request a replacement by contacting Mastercard Prepaid on 1800 303 297. Replacement cards are sent to you at your nominated address by standard post.

If the card is lost, stolen or damaged while you are overseas you can request a replacement by contacting Mastercard Prepaid on +44 207 649 9404. Replacement cards can be delivered to you, depending on your location and availability. Mastercard Prepaid may arrange for funds to be made available from various world-wide outlets, or to send funds directly.

Don’t have Travelex Money Card yet?

Why not buy the Travelex Money Card and get all the great benefits to enjoy all year round…

*Please be advised that although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au, before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.