Travelex Travel Money Card

Get our best rates with Travelex's award-winning travel card.

Please try again shortly.

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 15 currencies on your Travelex Money Card

- Manage your balance 24/7 through the Travelex Money App

- No commission or hidden charges

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

Travel Card Exchange Rates & Currencies

Choose from 22 currencies

The Travelex Money Card

Travel smarter with Travelex's award-winning overseas travel card. Tap and go at millions of locations worldwide, online or in-store, wherever Mastercard is accepted: simply use your card or phone via Google Wallet™.

Rated 5 stars by Canstar (2016-2020) and Mozo's Best Prepaid Travel Card (2022-2024).

Travel card benefits

Easy to use

- No fees when you buy online

- Unlimited FREE overseas ATM withdrawals1

- Convenient Travelex mobile app

- Shop at millions of outlets and websites wherever Mastercard prepaid is accepted

- Award winning travel money card

- Tap & go with your phone via Google Pay™ and Google Wallet™

Save on fees & earn cashback

- $0 Eftpos fees

- $0 ATM fees1

- $0 Currency conversion fees2

- $0 Online shopping fees3

- Earn cash rewards with Mastercard® Travel Rewards 6

Safe & supported

- Your bank account is not linked to the Travelex card

- Receive access to emergency funds4

- Stay protected with Mastercard's Zero Liability5

- Dedicated 24/7 Mastercard Global Support

- Temporarily lock your card if lost or stolen

How does a travel money card work?

Shop smarter, sooner with your Travelex travel card.

Compare Travel Money Cards

A prepaid travel money card can certainly come in handy. But with so many options available, finding the best travel card for an overseas trip can feel overwhelming. To help get you started on your travel card comparison journey, here's a rundown of what to look out for. We’ve compared some of the best travel money cards in Australia.

Currency to currency conversion calculator

Use our handy currency to currency conversion calculator to estimate the indicative exchange rate which will be applied when spending using an unsupported currency not on the Travelex Money Card.

Fees and limits

No fees online

No initial charges for card purchase and no currency conversion fees^.

Free replacement card

Enjoy peace of mind with our free replacement card* service, available if your card is lost, stolen, or damaged or access to emergency cash. *See section 15 of the PDS.

Flexible ATM withdrawal limits

Withdraw the equivalent of $3,000 AUD from ATMs worldwide within a 24-hour period.

Generous maximum card balance

Hold up to $50,000.00 AUD at any one time, easily accommodating all your travel plans.

Fees & limits disclaimer: The following fees and limits apply. Fees and limits are subject to variation in accordance with the terms and conditions. Unless otherwise specified, all fees will be debited in AUD currency.

If there are insufficient funds in AUD Currency to pay such fees, then we will automatically deduct funds from other currencies in the following order of priority: AUD, USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD.

|

Fees

|

|

|---|---|

|

Fee type

|

Fee

|

|

Initial card purchase

|

Free

|

|

No fee charged when purchasing a new Travelex Money Card. |

|

|

Top-up – foreign currency wallets

|

Free

|

|

No fee charged when topping up in foreign currency wallets. |

|

|

Top-up online or via app – AUD wallet

|

Free

|

|

No fee charged when topping up in an AUD local currency wallet online or via the Travelex Money App. |

|

|

Top-up at a store – AUD wallet

|

1.1% or $15 whichever is greater

|

|

Fee charged when topping up in an AUD local currency wallet in-store. |

|

|

BPAY top-up online or via app

|

Free

|

|

No fee charged when topping up using BPAY online or via the Travelex Money App. |

|

|

BPAY top-up – direct

|

1%

|

|

BPAY top-ups can be made directly using the following payment details. Topping up via the Travelex website or mobile app does not incur any fees.

Funds will be allocated to your default currency. To check your default currency login to your account. |

|

|

ATM withdrawal and EFTPOS (international)

|

Free

|

|

No fee for using ATMs or making EFTPOS payments internationally. Some ATM operators may charge their own fees or set their own limits. |

|

|

ATM withdrawal and EFTPOS (domestic)

|

Free

|

|

No fee for using ATMs or making EFTPOS payments internationally when withdrawing or making payments using an AUD wallet. Some ATM operators may charge their own fees or set their own limits. |

|

|

Cash over the counter

|

Free

|

|

Fee for withdrawing cash over the counter (for example, in a bank). They may charge their own fee. |

|

|

24/7 Global Emergency Assistance

|

Free

|

|

Access to 24/7 Travelex Money Card Global Assistance, which among other things, can arrange for emergency funds (up to the available balance of your Card) to be sent to you. |

|

|

Inactivity fee

|

4.00 AUD per month

|

|

Fee charged after a 12-month period of you not using your card (either by topping up your card, paying for transactions or withdrawing money), including after your card has expired. No fee if you have a zero balance.. |

|

|

Currency transfers

|

Free

|

|

No fee for moving money between wallets. At the then applicable retail foreign exchange rate determined by us. We will notify you of the exchange rate at the time you allocate your funds from one currency to another. |

|

|

Currency conversions

|

Free

|

|

Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/currencies used to fund the transaction. The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions. |

|

|

Limits

|

|

|---|---|

|

Limit type

|

Limit

|

|

Maximum number of active card accounts you may have at any one time

|

1

|

|

Minimum amount you can load on initial purchase (online and on the app)

|

$350.00 AUD

|

|

Minimum amount you can load on initial purchase (in-store)

|

$100.00 AUD

|

|

Minimum amount you can top-up

|

$50.00 AUD

|

|

Maximum amount you can load on initial purchase

|

$5,000.00 AUD

|

|

Maximum amount you can top-up in single transaction

|

$10,050.00 AUD

|

|

Maximum amount you can top-up within 24 hours

|

$10,050.00 AUD

|

|

Maximum amount you can top-up within 21 days

|

$20,000.00 AUD

|

|

Maximum BPAY® top up amount per day (When the transaction is not booked via www.travelex.com.au)

|

$25,000.00 AUD

|

|

Maximum amount you can have on your card at any one time

|

$50,000.00 AUD

|

|

Maximum amount you can have on your card during any 12 month period

|

$75,000.00 AUD

|

|

Maximum amount you can withdraw in 24 hours over the counter, i.e. at a bank

|

$350.00 AUD

|

|

Maximum amount you can withdraw from an ATM in 24 hours

|

$3,000.00 AUD

|

|

Maximum amount you can spend using EFTPOS

|

$15,000.00 AUD

|

Terms and conditions

Travelex Money Card terms and conditions and Travelex general terms and conditions

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

What our customers say

Find out why our community trust in Travelex

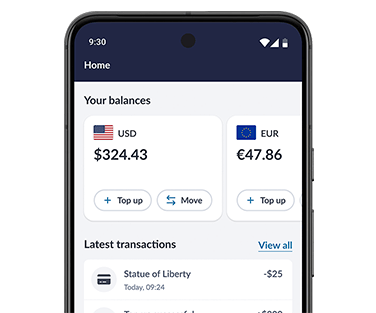

Download the Travelex Money App

- Top up your Travelex Money Card in a flash

- Manage your money on the move

- View your latest transactions and track your spending

- Instantly freeze your card to protect your account

Travelex travel card currency information

Save with AUD

Load AUD on your prepaid travel card and save when spending in the below currencies:

- IDR, AED, FJD, PHP, MYR, TWD, KRW, KHR, VND, CNY

- Free online AUD load and top-ups

- $0 International ATM fees1

Travelex Money Card FAQ

When purchasing foreign currency and travel money card online, the name on the order details must match the name on the payer’s bank account, debit or credit card. For this reason, a Travelex Money Card cannot be bought as a gift for someone else.

You can only hold one card in your name at any one time.

Mastercard card services and Travelex customer support centre are here to help.

Find who to contact here (local and international numbers).

Top-up via the Travelex website

- Note that you must use your unique reference number when paying or the transfer may be delayed.

Top-up via the Travelex Money App

- Note that you must use your unique reference number when paying or the transfer may be delayed.

Move currencies on your card, instantly!

- If you have AUD (or any other currency) already loaded on the card, you can move your funds to another currency within the Travelex Money App. Instant top-up!

Top-up in a Travelex store

Direct top-up via BPAY:

- Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

You must make payment using your own account. - MasterCard Biller Code: 184416

Reference No: your 16 digit Travelex Money Card number - Funds will be allocated to your default currency. To check your default currency login to your account.

Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

The best travel money card for Australians heading overseas is the one that caters to the currencies available at your destination, removes ATM withdrawal and foreign purchase fees, and has the best exchange rate.

Find our exchange rates for all major currencies and plan your holiday today.

The Travelex Money Card is a prepaid travel card and has been awarded the best prepaid travel money card by Mozo three years in a row.

Yes — if you want to lock in foreign currency exchange rates, avoid foreign transaction fees, and carry multiple currencies on one secure prepaid travel card, the Travelex Money Card is a smart choice.

It works like a debit card, with no overseas ATM fees¹, and is easy to top up and manage via the Travelex Money App. Ideal for frequent travellers, short trips or anyone wanting a safer alternative to carrying cash or using a standard travel bank card.

Order your card online in minutes.

A travel money card — also known as a currency card or cash card for travel — is a reloadable prepaid card that allows you to store and spend multiple foreign currencies while overseas.

It works like a debit card, but with travel-specific benefits: you can lock in exchange rates, avoid foreign transaction fees, and easily track spending through tools like the Travelex Money App.

Order your prepaid travel card online or pick one up at your nearest Travelex store today.

It depends on how you choose to order:

- Order online & pick up in-store: Pay via PayID or card and collect your prepaid travel card as early as the next day, when the order is placed before 2:30pm AEST.

- Buy in-store: Visit a Travelex store to purchase and load your card on the spot. It’ll be ready to use immediately.

- Activation: Travelex travel cards ordered online for in-store pickup or purchased directly in-store do not require activation.

The Travelex Money Card is a Mastercard travel card, meaning it is free to make international withdrawals at ATMs displaying the Mastercard acceptance mark. It is also free to obtain cash over the counter and to make online purchases with a travel money card. However, some ATM operators may charge their own withdrawal ATM fees. Be sure to check with the ATM in question prior to making cash withdrawals.

Yes — you can withdraw money from ATMs worldwide using your Travel Money Card.

To avoid unnecessary fees, choose the “credit” option at the ATM. If that doesn’t work, try “debit” or “savings”. You won’t be charged credit card fees when withdrawing this way, but keep in mind:

- You can withdraw up to $3,000 Australian dollars every 24 hours

- Some ATMs may charge their own fee, which is separate from Travelex

-

For best results, check local ATM fees and withdrawal limits before you travel.

The Travelex's preapid travel card is a multi currency card that can be used in most countries around the world. Widely considered one of the best overseas travel card, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

Plus, if your preferred currency cannot be directly loaded onto the card, you can still load AUD and use it as a secure alternative to cash.

Learn more about our special offer for AUD loads in certain countries.

Travelex stores abroad can’t access your Australian-issued Travelex Money Card, so they won’t be able to provide balance enquiries or offer cash-out.

- To check your balance, use the Travelex Money App or call us on 1800 440 039.

- Cash-out may be offered in local shops that provide this service.

The initial card fee is free, subject to minimum load amounts. Usage fees may apply depending on how you use your travel card — including transaction type, currency used, and currency conversions. Limits also apply to top-up amounts and methods.

Please see more information on applicable fees and limits section.

Your Travelex Money Card is monitored daily for unusual activity. If anything suspicious is detected, we’ll contact you to verify your transactions.

You can also take steps to protect your card and travel money:

- Sign your card as soon as you receive it

- Regularly check your transactions and report anything suspicious to Card Services

- Keep printed statements secure and shred them when no longer needed

- Never share personal details over the phone or in response to unsolicited emails

- Be cautious of anyone asking for sensitive info like your PIN, passwords, or security questions

- Stay alert at ATMs and payment terminals — don’t let anyone distract you while entering your PIN

Still have questions?

Explore our support categories for more help.

The basics

Basic information about the Travelex Money Card.

Getting started

Details on obtaining and eligibility for the card.

PIN

Information about you Pin.

My account

Managing your Travelex Money Card account.

Using the card

Card usage, currencies, and topping up.

ATM usage

Your card and ATM usage.

Google pay

Details about adding your card to a Google Wallet.

Fees and limits

Information on fees and limits.

Lost Card

Support for lost/stolen cards.

Support

Contact details for further assistance.

- 1 Please be advised that although Travelex do not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using

- 2 A foreign exchange ‘Spend Rate’ rate will apply to foreign exchange transactions in accordance with The Product Disclosure Statement.

- 3 Transacting via some online merchants may incur a surcharge.

- 4 Customers must contact Mastercard Customer Service to report lost or stolen card. Emergency cash can be arranged up to the balance of your Travelex Money Card, subject to availability of funds at the approved agent location.

- 5 As a Mastercard holder, Zero Liability applied to your purchases made in store, over the phone, online, or via mobile device and ATM transactions. You will not be held responsible for unauthorised transactins if you have used reasonable care in protecting your card from loss or theft, and you promptly report loss or theft. For more information, please visit the Mastercard Zero Liability Terms and Conditions page.

- 6 Terms and Conditions apply for the Mastercard Travel Rewards program. Please see the Mastercard Travel Rewards terms and conditions. This rewards program is available on the Travelex Money Card until the 31st of December 2024 or may be extended or withdrawn and you may receive prior notice where it is reasonably practicable to do so.

- Google Pay and Google Wallet are trademarks of Google LLC. Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au, before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Further information relating to Finder Award win can be found below:

a. https://www.finder.com.au/finder-awards/customer-satisfaction-awards/travel-money-card-satisfaction