Travel Money Card for Hong Kong

The Travelex Money Card features a transaction account so that you can store and use HKD (and any other foreign currency you need) in Hong Kong, hassle free.

Rather than carrying bundles of HKD cash around, you can use the Travelex Travel Money Card to make card payments as you would at home (compatible with Mastercard). Not only that, but you can also lock in a favourable applicable exchange rate before transferring funds to your travel money card.

The Travelex Travel Money Card is an award-winning multi currency card that is perfect for exchanging and transferring HKD (Hong Kong dollar) during your travels. Suitable for use wherever Mastercard is accepted and with no foreign transaction fees^, the prepaid travel money card can make travelling around the city easy.

You can enjoy great online exchange rates, fee-free cash withdrawals, and all the benefits of a standard debit card with the Travelex Travel Money Card.

UNLIMITED FREE overseas ATM withdrawals1

Highly competitive exchange rates

NO fees when you buy online

$0 Currency conversion fee^

24/7 Global Assistance

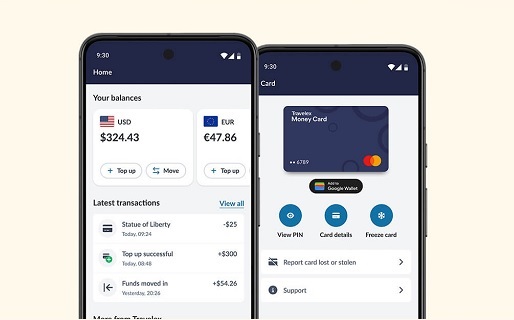

Convenient Mobile App

Download it here

Shop at millions of outlets wherever Mastercard is accepted and on international websites with the local currency

Buy online or collect in-store

5☆ outstanding value award winning travel money card

Earn cash rewards for shopping with Mastercard Travel Rewards

TAP & GO with your Android phone via Google Pay™ and Google Wallet™

Read more

Maximise your holiday with our travel card

Order your travel card

Order your Travelex Money Card online or in-store (passport or driver's license required)

Get your travel card

Collect from a Travelex store

Register for My Account

To activate your new card, simply register your account via the app or online

Top Up

Manage and check your balance online and on your mobile

Experience the benefits

- Top up your Travelex Money Card wallet

- Check your balance and move funds between currencies

- Instantly freeze and unfreeze your card

- Reveal your PIN and card details for online shopping

The app requires Android 8.0 and up or iOS 14.0 or later.

Compatible with iPhone, iPad and iPod touch.

NO fees online

$0 Currency conversion fee^

Withdraw daily up to AU$3,000 (or currency equivalent)

Maximum Card limit of AU$50,000

Free initial and replacement card

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

(charged at the time of purchase)

• Online: FREE via travelex.com.au or the Travelex Money App

• In-Store: FREE for loads of foreign currency (loads of Australian dollars (AUD) incur a fee of 1.1% of the amount or $15 whichever is greater).

• Online: FREE via travelex.com.au or the Travelex Money App

• In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater).

• BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount.

- MasterCard Biller Code: 184416

- Reference No: your 16 digit Travelex Money Card number

- Funds will be allocated to your default currency. To check your default currency login to your account.

FREE (note: Some ATM operators may charge their own fees or set their own limits)

FREE (note: Some ATM operators may charge their own fees or set their own limits)

FREE

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

AU$4.00 per month

FREE

- Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.

AU$10.00

- This is applied when you move your funds from one currency to another currency.

At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another.

- Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.

FREE*

*The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

One

Minimum amount for initial purchase in-store

AU$500 or currency equivalent

AU$500 or currency equivalent

AU$50 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is AU$5,000 equivalent.

to a maximum of $10,050 per single top-up; and

to a maximum of $10,050 top-up value over 24hrs; and

to a maximum of $20,000 top-up value over 21 days.

AU$25,000

AU$75,000

AU$350

AU$3,000 or currency equivalent

AU$15,000 or currency equivalent

AU$50,000

Other Important Information

Please read the following information about your Travelex Money Card carefully:

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

- The ability to lock in a fixed exchange rate before travelling

- The ability to store and buy multiple foreign currencies in a travel money card account with one card (including HKD)

- Avoiding transaction fees such as overseas ATM withdrawal fees and annual fees

- The security of having funds at hand when travelling

NZ

NZ

Europe

Europe

US

US

Japan

Japan

UK

UK

Canada

Canada

Hong Kong

Hong Kong

Thailand

Thailand

Singapore

Singapore